« June 17, 2009 | Main | June 22, 2009 »

June 19, 2009

Jammie Thomas file-sharing case: Virgin Records et al. win again.

So justice really is hard--even harsh. We've followed and written about this one for over two years: Virgin Records America, Inc. v. Thomas, 06-1497, D. Minn. 2006. Yesterday, the same result--and we think the right one--was obtained in the re-trial of the case against a sympathetic defendant. Jammie Thomas is single mother of modest means who was sued for downloading music in violation of copyright laws. Music industry plaintiffs focused on only twenty-four out of hundreds of likely infringements by Thomas.

Seven record companies claimed against her, alleging willful infringement, and exposing Thomas, then about 30, to big penalties. U.S. District Judge Michael Davis presided over the first trial in 2007; he ordered a new trial after deciding he had erred in jury instructions. We hope to write more later about the dispute--and what it means for hundreds just like it. In the meantime, there's no shortage of news coverage. See Associated Press:

Jury Rules against Minnesota Woman in Download Case

MINNEAPOLIS (AP)--A replay of the nation’s only file-sharing case to go to trial has ended with the same result, finding a Minnesota woman to have violated music copyrights and ordering her to pay hefty damages to the recording industry.

A federal jury ruled Thursday that Jammie Thomas-Rasset willfully violated the copyrights on 24 songs, and awarded recording companies $1.92 million, or $80,000 per song.

Thomas-Rasset's second trial actually turned out worse for her. When a different federal jury heard her case in 2007, it hit Thomas-Rasset with a $222,000 judgment. [more]

Posted by JD Hull at 11:47 PM | Comments (0)

Financial regulation in America: A British view.

See an opinion piece entitled "Better broth, still too many cooks" in this week's The Economist. It is a critique of the Obama administration's plans (and new white paper) for U.S. financial reform. The article hits a high note in the beginning: a portrait of a vast, clumsy, and myopic animal that is our current system of financial regulation:

There is both too much of it and too little. Multiple federal agencies oversee the financial system: five for banks alone, and one each for securities, derivatives and the government-sponsored mortgage agencies. They share these duties with at least 50 state banking regulators and other state and federal consumer-protection agencies.

Yet all these regulators failed to anticipate and prevent the worst financial crisis since the Depression, because risk-taking flourished in the cracks between them. Toxic subprime mortgages were peddled by lenders with little federal oversight and shoved into off-balance-sheet vehicles. The greatest leverage accumulated in firms that avoided the capital requirements of banks.

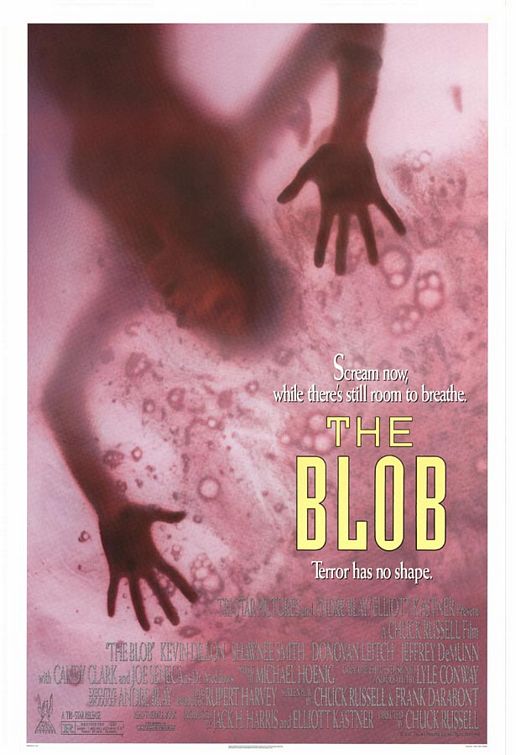

TriStar Pictures, Inc.

Posted by JD Hull at 05:31 PM | Comments (0)