« October 2013 | Main | December 2013 »

November 25, 2013

William Jefferson Clinton: The First Bubba in 2017?

Dang. In 2017 we might see Hillary Rodham Clinton, who will have turned 69 just before election day in 2016, sworn in as the nation's first female POTUS. Her White Housemate? One William Jefferson Clinton, who will then be 70. No matter what your politics, it does sound like fun. What, if anything, do you think about this? Can we hear from commentariat-pundit-pollsters like Mike O'Neil?

Posted by JD Hull at 11:59 PM | Comments (0)

November 24, 2013

Co-Workers: Please Oh Please Try To Steal My Clients.

Lawyers--especially of the corporate variety--are far from the Fighters and Alpha People portrayed in Television Dramas and in the Media. We're among the most Fearful and Insecure Creatures on Earth.

If you find this performance review idea preposterous, please ask yourself why. We first mentioned the title's idea in a 2006 post. It attracted attention--but many people thought we were kidding. We weren't.

Some lawyer-writers tried to even analyze it, which was strange, and kind of sad. Lawyers--after actors, junior high kids at that first dance, and aging beauty queens just discovering pharmaceutical speed--have to be the most insecure creatures on earth. They think in terms of scarcity--never in terms of plenty.

Someone else is about to get something that is theirs.

Again, friends, it's time to have the courage of your convictions--and otherwise get "off your lawyer knees".

There are lots of suggestions out there on standards, guidelines and take-aways for associate reviews.

Two are (a) letting staff evaluate co-workers and partners on specific inter-office skills in writing, and (b) reviews of staff based on specific client service standards which ALL employees must buy into (i.e., pay increase for well done client service; hit the road, for the unwilling, clueless).

But we still like this one--which is no more discretionary and arbitrary than (a) and (b) above:

Every day, the client service by associates and paralegals should be good enough to permit those employees to actually steal any client, and take them to another law firm (use "transport" for "steal" if you need the PC professional services term), if they were to leave your shop tomorrow morning.

Period.

If you are not, in effect, willing to go that far with your own employees in instituting and daily demanding client service, you are neither confident about client loyalty (not to mention employee loyalty) nor really serious about delivering superior client service to your clients. You are a client-service fraud.

And your employees aren't in the game; they are not engaged in the work for clients, they are not stepping up.

A true client service culture has to be that "extreme". So let "them that can" whisk those clients out of your firm with a phone call or two; after all, that's only fair to the clients, if they so decide. If you find this idea preposterous, radical or just too disturbing, please think very hard about what you are really doing at your firm, and your real commitment, to build and lead a true client service culture.

At your shop, is "client service" just drinks-and-dinner b.s. for the clients, and website-and-brochure lip service for the public? Or is it real?

Posted by JD Hull at 12:59 AM | Comments (0)

November 14, 2013

Redux: In a Global Services Economy, could "Ease of Use" ever catch on?

Get off your knees. Imagine a Better Standard. Get to work.

"Client Service" for professionals. It got to be a joke almost right away, don't you think? But it doesn't have to be a joke. Client Service. In our view, that huge gap between the promise and the reality has rendered the term nearly meaningless. Even for those who deeply care about the crusade of delivering "it", and see its value for client retention, "client service" eludes the best of us.

We had no idea that building a client service culture and keeping it would be so hard.

It's a mantra we repeat to ourselves, to our employees, and to our customers. We believe that if we say "it" enough, "it" will come. With the best intentions, service providers really do institute--but rarely work at and enforce--regime after regime of Client Service.

The reason: Client Service is much much harder than it looks. You weave your skills into a buyer's "experience" of them, and deliver them together as One Thing. CS is a hard-acquired habit. It never was easy. Never supposed to be easy.

Most of us gave up. So we just talked about "it" in promotional materials and at meetings. We didn't establish and enforce it. (And lots of the time, if we were honest, we'd admit to ourselves we really didn't know what it was. It's just "being nice" to clients, right?)

What if the services sector, now King, competed for clients and customers on the basis of "Ease-of-Use"? Develop and apply ease-of-use concepts for products and goods to pure services? To our clients' services?

And to our services? Law. Accounting. Consulting. Advertising. Newer and non-traditional services, too. Anything where a service (something valuable but "invisible") or product-service mix is part of what you pay for.

In other words, Ease-Of-Use for services.

"Ease of use" is already intuitive to large armies of managers and employees who work in any services industry and don't like Hallmark cards. They already get it. It just needs to be seized upon, delivered daily, and enforced at your shop.

Well, why not? Why wait for the "Who Swiped My Cheese?" crowd to write a few books? Services are pretty much Everything these days.

Services certainly represent the direction global markets now march--in good and bad times.

Consider for a moment just products. In 2006, The Folgers Coffee Company was awarded an Ease-of-Use Commendation by the Arthritis Foundation for its AromaSeal™ Canister. If you're a Folgers® drinker, you notice that Folgers® added an easy-to-peel tin freshness seal (no need for a can-opener), a new "snap-tight" lid and even a grip on its plastic red can.

Folgers® did it for coffee cans. IBM and CISCO have ease-of-use programs for the products they sell. The great companies many of us represent do spend money and expertise on making their goods, equipment and products usable.

Think about your car, your luggage, your TV remote (well, strike that one), your watch and even grips on household tools. Think about Apple, Dell and Microsoft. Each year they think through your experience with their products and try to make it better. Continuous improvement models for "things."

Develop and apply ease-of-use concepts to pure services? Our clients' services? Our services? Sure, why not? It's probably coming anyway, even while it will be infinitely harder to do for services than for products. WAC? has noted before that even corporate clients that sell goods see themselves as selling solutions and not products.

By 2005, services sold alone or as support features to the sale of goods and products accounted for over 65% of the gross domestic product (GDP) in the US, 50% of the United Kingdom's GDP and 90% of Hong Kong's. Even products sold by IBM and CISCO, now chiefly service companies, are part of a services-products mix in which the services component is the main event.

Law firms, of course, have always sold services. And we are a small but powerful engine in the growth of the services sector. We strategize with and guide big clients every day. While that's all going on--day in and day out--what is it like for the client to work with you and yours? Are clients experiencing a team--or hearing and seeing isolated acts by talented but soul-less techies?

Do you make reports and communications short, easy and to the point? Who gets copied openly so clients don't have to guess about who knows what? Is it fun (yeah, we just said "fun") to work with your firm? How are your logistics for client meetings, travel and lodging? Do you make life easier? Or harder? Are you accessible 24/7? In short, aside from the technical aspects of your service (i.e., the client "is safe"), do your clients "feel safe"?

What if law firms--or any other service provider for that matter--"thought through," applied and constantly improved the delivery of our services and how clients really experience them?

And then competed on it...?

(from several WAC? ease-of-use posts beginning in 2007)

Posted by JD Hull at 01:59 AM | Comments (0)

November 10, 2013

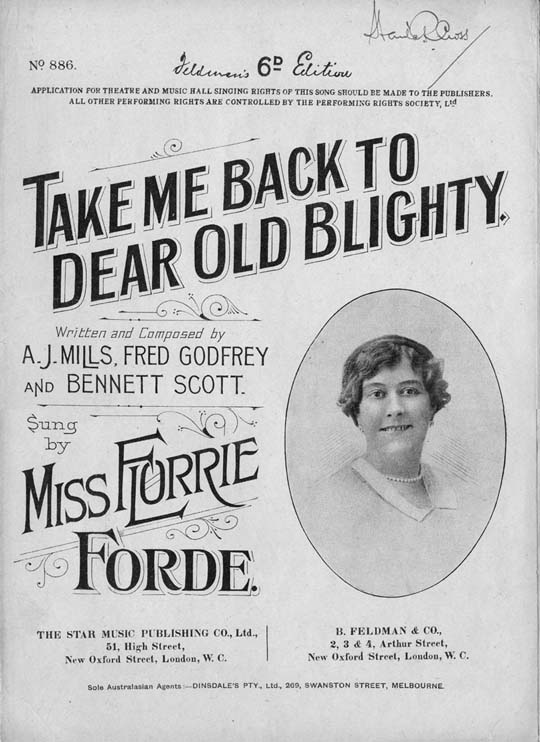

Veterans Day: “Though Poppies Grow In Flanders Fields."

Veterans Day is always on November 11, and comes to us from World War I, or the Great War. The first and most horrific of modern wars was officially over with the Treaty of Versailles in June of 1919. But November 11 is observed in about 60 (mostly Commonwealth nations) as Remembrance Day, Poppy Day or Armistice Day to mark the end of major fighting in World War I in the 11th hour of the 11th day of the 11th month of 1918, when Germany had signed the Armistice. As "Poppy Day", it derives its name from John McCrae's short but famous poem.

In Flanders Field

In Flanders fields the poppies blow

Between the crosses, row on row,

That mark our place; and in the sky

The larks, still bravely singing, fly

Scarce heard amid the guns below.We are the Dead. Short days ago

We lived, felt dawn, saw sunset glow,

Loved and were loved, and now we lie,

In Flanders fields.Take up our quarrel with the foe:

To you from failing hands we throw

The torch; be yours to hold it high.

If ye break faith with us who die

We shall not sleep, though poppies grow

In Flanders fields.--John Alexander McCrae (1872–1918). Poet, physician, Lieutenant Colonel of the Canadian Expeditionary Force. The poem first appeared in Punch in December of 1915.

McCrae in 1912

Posted by JD Hull at 11:59 PM | Comments (0)

November 08, 2013

The Economist: Time for Britain to Turn Outward.

In the next five years, will Britain take a proactive role in the European community? Or will it turn inward? Will it lead, or merely observe the Continent from its reliable safe distance across the English Channel? Will the UK even stay in the European Union? Do see in this week's The Economist Little England or Great Britain? Excerpt:

Britain once ran the world. Since the collapse of its empire, it has occasionally wanted to curl up and hide. It can now do neither of those things. Its brightest future is as an open, liberal, trading nation, engaged with the world. Politicians know that and sometimes say it: now they must fight for it, too.

Posted by JD Hull at 09:39 PM | Comments (0)

November 05, 2013

Qualify your clients. Get a system. Something...

J. Geils Band

Posted by JD Hull at 07:50 PM | Comments (0)

November 01, 2013

Goodbye, Old Friend.

"Ed. Post" (? - 2013), the anonymous editor of Blawg Review. Thank you. Rest in peace. And make it count, sir. I am sorry we quarreled so much.

Posted by JD Hull at 11:54 PM | Comments (0)

The Economist on MLPs: "Gaming" Sarbanes-Oxley.

.jpg)

Under the U.S. Code, only certain businesses are permitted to become publicly-traded entities known as Master Limited Partnerships (MLPs). Most MLPs are fossil-fuel energy companies. Think major pipeline systems delivering natural gas, crude oil and refined fuels to end markets. MLPs offer the tax benefits of a partnership, the liquidity of publicly-traded stocks, the limited liability of a corporation and, importantly, the governance of a privately-held firm. See The Economist's new piece on MLPs in Subterranean Capitalist Blues and its typically snarky take on American finance "gaming" the corporate governance rules of Sarbanes-Oxley. Excerpt:

Time and again, the imposition of new burdens on businesses distorts the flow of money. Enron’s demise led to the Sarbanes-Oxley act, a well-intentioned law that changed the economic calculus for going public in America. Finance has yet to meet a rule it doesn’t want to game. Before the crisis, regulations that made it relatively expensive for banks to hold assets encouraged them, disastrously, to squirrel them away in off-balance-sheet vehicles.

Since the crisis, the regulatory burden on firms has shot up. Many of the new rules designed to make finance safer—raising capital levels, improving transparency in derivatives markets—are vital. Plenty are laudable: allowing “say on pay” votes for shareholders, for example. But the effect is the same: capital is again flowing to where frictions are lowest. As the constraints on regulated banks pile up, the global shadow-banking system grows: from $62 trillion in 2007 to $67 trillion in 2011.

Even when rules are rolled back, new distortions can easily result. The 2010 Dodd-Frank act permanently exempted smaller public companies from some of the most burdensome elements of Sarbanes-Oxley, for example. But some firms deliberately stay small in order not to pass thresholds that would trigger tougher rules. The perversity is breathtaking: rules to protect investors encourage firms not to grow.

Posted by JD Hull at 07:32 PM | Comments (0)